I nearly spit out the hard apple cider I was drinking when I heard the following exchange during the first Democratic presidential debate:

Anderson Cooper: Senator Sanders wants to break up the big Wall Street banks. You don’t. You say charge the banks more, continue to monitor them. Why is your plan better?

Hillary Clinton: Well, my plan is more comprehensive. And frankly, it’s tougher…

Sure, Clinton’s plan has, as financial systems expert Mike Konczal notes, significantly more “footnotes and wonky details.” If that’s what “more comprehensive” means, so be it. But tougher? More “characterized by severity or uncompromising determination,” as Merriam-Webster’s puts it?

To me, the best, most concise summary of the two candidates’ plans for Wall Street banks thus far comes from former US Labor Secretary and current Berkeley professor Rob Reich:

Bernie Sanders says break them up and resurrect the Glass-Steagall Act that once separated investment from commercial banking.

Hillary Clinton says charge them a bit more and oversee them more carefully.

Which of those options sounds tougher to you?

Konczal also highlights that Sanders, unlike Clinton, “wants to take on the power of the big banks.” In addition, the two candidates’ approaches to curbing high-frequency trading “is a clear difference, with Sanders taking a more aggressive approach.”

Clinton didn’t possibly expect anyone to believe that she’d be tougher on Wall Street than Sanders, did she?

Imagine my surprise upon opening up a recent Paul Krugman article – expecting the excellent economic and political analysis he so often provides – and seeing that, in the candidates’ dispute “about whose plan was tougher,” he thought “Mrs. Clinton had the better case.”

Krugman points out, as does Konczal, that while Clinton has already laid out details on how she plans to conduct oversight of the “shadow” banking sector, Sanders hasn’t. Krugman sees a specific plan in this area as more important than a commitment to break up the big banks. This argument is fine to make, though it’s worth noting that Reich disagrees.

But the more important topic, Krugman argues, is tough-on-Wall-Street credibility. And what’s baffling to me about his analysis is that he seems to think Clinton has it, a position completely at odds with the campaign finance data and Clinton’s record.

The crux of Krugman’s argument is that, while “there was a time when Wall Street and Democrats got on just fine…with the securities industry splitting its donations more or less evenly between the parties,” that time has passed. He writes:

[I]f Wall Street’s attitude and its political giving are any indication, financiers themselves believe that any Democrat, Mrs. Clinton very much included, would be serious about policing their industry’s excesses. And that’s why they’re doing all they can to elect a Republican…

Financial tycoons loom large among the tiny group of wealthy families that is dominating campaign finance this election cycle — a group that overwhelmingly supports Republicans. Hedge funds used to give the majority of their contributions to Democrats, but since 2010 they have flipped almost totally to the G.O.P.

As I said, this lopsided giving is an indication that Wall Street insiders take Democratic pledges to crack down on bankers’ excesses seriously. And it also means that a victorious Democrat wouldn’t owe much to the financial industry…

Krugman is right about the overall trends. A tiny group of wealthy families is contributing millions of dollars to 2016 presidential campaigns, most of it to Republicans, and the balance of hedge fund donations between the two parties has definitely shifted. But those overall trends mask one crucial exception to the rule: Hillary Clinton.

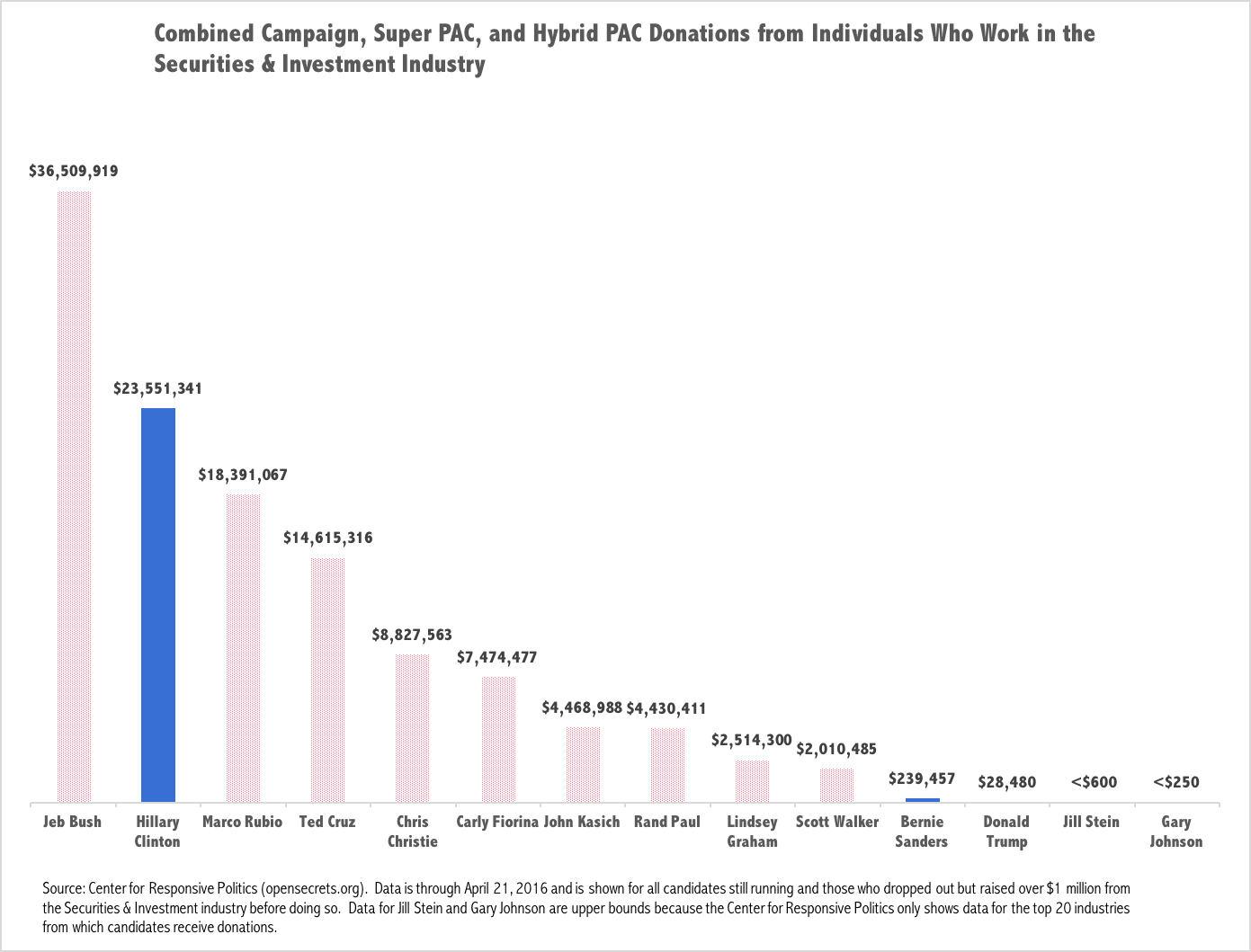

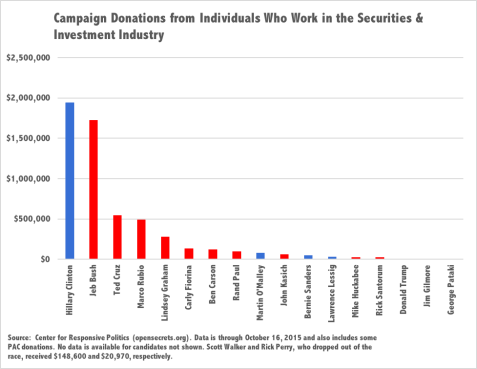

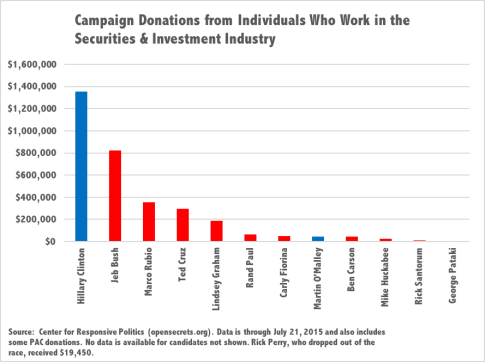

The Center for Responsive Politics collects data on donations campaigns receive from individuals who work in the “Securities & Investment” industry, which is shown below. While the organization recognizes that “not every contribution is made with the donor’s economic or professional interests in mind[, there is] a correlation between individuals’ contributions and their employers’ political interests.” In addition, the “donors [they] know about, and especially those who contribute at the maximum levels, are more commonly top executives in their companies, not lower-level employees.”

As the chart shows, Clinton actually leads all Republican candidates in contributions from this industry. She has received over 40 times more money than Sanders has from individuals associated with Wall Street. That’s lopsided giving all right, but it’s lopsided in a much different way than Krugman suggests.

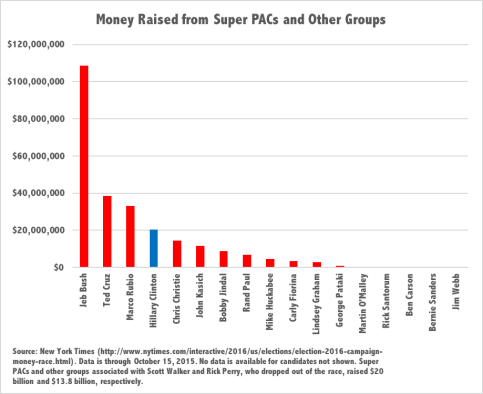

Candidates receive considerably more financial support from Super PACs than from individual donations, but Clinton ranks among the Republicans in this category, too. Jeb Bush, Ted Cruz, and Marco Rubio outpace her (Bush by a considerable margin), but her $20.3 million in Super PAC money is exactly $20.3 million more than Sanders has received. While it’s not clear how much of any candidate’s Super PAC money comes from Wall Street, and while I suspect that Clinton Super PAC donors George Soros and S. Donald Sussman are more amenable to basic regulations than their fellow billionaire hedge fund managers who donate to Republicans, it seems plausible that a “victorious Democrat” – if that Democrat were Hillary Clinton – might, in fact, “owe much to the financial industry.” And that’s before even considering donations to the Clinton foundation.

Those donation profiles suggest that Sanders, despite not having a specific proposal on “shadow” banking yet, is far more likely than Clinton to fight for smart recommendations from folks like Konczal.

I find it especially hard to understand Krugman’s argument in the context of what Clinton touted as a tough-on-Wall-Street credential during the debate:

I represented Wall Street, as a senator from New York, and I went to Wall Street in December of 2007 — before the big crash that we had — and I basically said, “cut it out! Quit foreclosing on homes! Quit engaging in these kinds of speculative behaviors.”

I don’t know about you, but I don’t typically think representing a group of rich people and giving them a nonbinding but stern talking to qualifies as particularly tough. History backs me up on this one – Clinton’s Wall Street lecture doesn’t seem to have worked out so well.

Paul Krugman is a great economist, I love his column, and I understand the point he’s trying to make: he thinks a Democrat in the White House – any Democrat – would be a hell of a lot better than any Republican.

But even if you agree on that point, don’t buy the idea that the practical difference between Clinton and Sanders is trivial. It’s very large when it comes to Wall Street, where Sanders is tougher by any reasonable definition of the word.

Note (10/22/15): I updated this post with new data from the Center for Responsive Politics; the old graph, which appeared in the original version of this post, is shown below. At that time (as the original version of the post noted), Sanders had “received so little from the Securities & Investment industry that the Center for Responsive Politics [didn’t] even report it.”

Update (5/12/16): The Wall Street Journal reports that “Hillary Clinton is consolidating her support among Wall Street donors and other businesses ahead of a general-election battle with Donald Trump, winning more campaign contributions from financial-services executives in the most recent fundraising period than all other candidates combined.” In addition, “some Wall Street donors have shifted their financial support from Republican candidates who dropped out of the race, such as former Florida Gov. Jeb Bush and Florida Sen. Marco Rubio, to Mrs. Clinton in recent months.” The most recent data from the Center for Responsive Politics, shown below, includes both donations made directly to the campaigns and those made to candidates’ Super PACs.

Leave a comment